Contents:

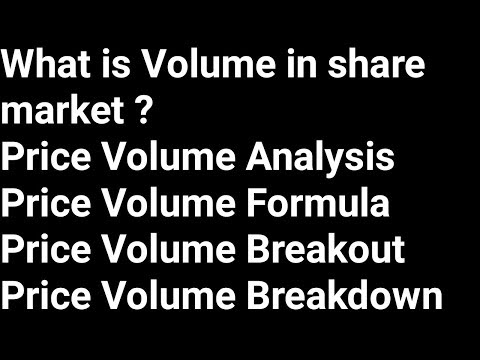

This would have bearish implications, especially at high price levels. Another note of caution in using the OBV is that a large spike in volume on a single day can throw off the indicator for quite a while. In this image here, we see that the OBV line is rising, driving the prices higher and consequently developing a bullish trend.

- The tool can be used by insurance companies to insure the vehicles.

- When both price and OBV are making higher peaks, the upward trend is confirmed.

- Use indicators after downloading one of the trading platforms, offered by IFC Markets.

- E) Trading / Trading in “Options” based on recommendations from unauthorised / unregistered investment advisors and influencers.

- If share prices are rising along with OBV, increased volume is reflected by the buyers, even at higher price levels and the trend would be bullish.

As the OBV calculates the volume on a cumulative basis, the real number value depends arbitrarily on the chosen starting point. This makes the individual quantitative value of OBV less relevant, making it an unsuitable indicator for day traders. You may confirm the advanced breakout with that of positive divergence of Stochastic, to place your trade for the upside. This is the signal which tells us that price will also cross the previous top. In fact, a non-confirmation is a matter of weakness whereas advanced breakout is a matter of strength. The tool can be used by insurance companies to insure the vehicles.

Advanced breakdown

In a downtrend, Price and On Balance Volume, both are expected to move in the same fashion where both will make lower tops and lower bottoms. Many people are willing to sell and buy but they are not sure of the price. That is where the Orange Book Value comes and plugs in the gap. I consulted many used vehicle dealers but couldn’t get a satisfactory price. Then I heard about Orange Book Value from a friend, and using it helped me to purchase at right price. Calculate right Insured Declared Value of any used vehicle using OBV.

- This is the state when higher highs are formed by OBV but price remains range bound.

- Lagging technical indicators show past trends, while leading indicators predict upcoming moves.

- As a pure-play automobile e-commerce company, we provide a platform for buyers and sellers to transact vehicles and related services.

The OBV line is simply a running total of positive and negative volumes. A period’s volume is positive when the close is above the prior close and is negative when the close is below the prior close. An advanced breakdown is suggestive that the price will decline further and breach the previous bottom, and is seen as a sign of weakness with respect to the price.

A change in the direction of the OBV can foreshadow a potential reversal in the price direction. The OBV line is a cumulative total of both positive and negative volume. A period’s volume is positive if the closing price is higher than the previous day’s and a period’s volume is negative when the closing price is lower than the previous day’s. The chart above shows how the OBV line rises and falls corresponding to the variations in the price chart.

Share this Comment:

It is simple addition or subtraction of volume depending on change of closing price from previous days. If share prices are rising along with OBV, increased volume is reflected by the buyers, even at higher price levels and the trend would be bullish. Meanwhile, if price and OBV are declining, it shows stronger volume from sellers and lower prices should continue. For example, when traders start to invest heavily in a particular asset, the volume of trades goes up.

The OBV number is calculated by adding the volume on days when the price ends higher compraed to the previous day and subtracting the volume on days when the price ends lower. With time, as more and more research came into the subject, the theory of on-balance volume was developed that soon became an indicator in the technical analysis of securities. However, in the case of a non-confirmation of a downtrend, the volume and price will stop moving in the same direction, that is, the price may break the last bottom but the volume may not.

Check Fair Market Value for any Vehicle

Use OBV Pricing certification services before writing-off auto loan for used vehicles. Stock brokers can accept securities as margins from clients only by way of pledge in the depository system w. Since this oscillator does not have a specific minimum and maximum, just setting the maximum and minimum does not seem the best thing to do. Below accounts are used for other internal purposes and should not be used to transfer money to Upstox.

Intuitive Surgical Isn’t The Only Attractive Healthcare Stock – TheStreet

Intuitive Surgical Isn’t The Only Attractive Healthcare Stock.

Posted: Wed, 19 Apr 2023 20:01:00 GMT [source]

Another limitation of the OBV is that it can be a little hard to identify divergences using this indicator and therefore it can’t be used effectively alone. Another possible drawback of OBV is that it doesn’t tell much about the asset as such. OBV can predict major highs and lows and can be particularly useful in measuring the breakout and breakout potential. This happens when the price has failed to break the previous bottom whereas On Balance Volume has broken the previous bottom. Please type the OTP you have received in your registered mobile no. An advanced breakdown indicates that price will also break the bottom.

When On Balance https://1investing.in/ and price both follow the same direction, regardless of the trend, we can draw a trend line in price as well as in volume to watch pattern similarities. But at times price will fail to break the previous bottom whereas On Balance Volume will break the previous bottom. Here the price will make a new higher top but On Balance Volume will fail to make a new higher top. During an uptrend On Balance Volume will follow the price direction and will keep on making a higher top and higher bottom.

Sign in to read the full article

OBV is easy to calculate, as it is simply the sum of volume from a specific ‘starting date’. These days both day trading and robotic trading activity has increased which leads to high volume activity and thereby affecting quality volume analysis. The chart for Educomp Solutions Ltd shows a bullish divergence forming in September.

get someone to vote on your behalf proxy votingly such data is picked through market feedback which results in non-standard data quality. The objective of this indicator is to be a leading indicator that can detect a large price change before it happens. It is based on the On Balance Volume indicator, which is a leading indicator based on the premise that a large change in volume often precedes a large price change. This indicator charts the N-Period deviation of the OBV data and displays it…

Nabors Industries Is Sending Mixed Technical Signals Ahead of … – RealMoney

Nabors Industries Is Sending Mixed Technical Signals Ahead of ….

Posted: Mon, 24 Apr 2023 12:00:00 GMT [source]

Volume seems to be a pretty big deal for traders who are always trying to judge whether a gain in stock prices is the start of a huge uptrend or just a fake out in the wrong direction. The On Balance Volume trading indicator attempts a quantified approach towards volume flow in and out of the stock. It adds volume on up days and subtracts volume on down days. Previous editions discussed several indicators like ROC, MACD, RSI. These are based on pure price movements. Since volume is also an important factor in technical analysis, let us now learn some indictors that take volume into account and On Balance Volume indicator is one of them.

Notice how HDIL broke it’s down trend line in late February and OBV confirmed with a breakout in March. Using the OBV indication a trade can gauge the relationship between volume of a scrip and the price of that scrip. The OBV indicator gives you the net volume figure after adding or subtracting the volume of the day/session to the cumulative volume figure and confirms the price trend.

Trading in “Options” based on recommendations from unauthorised / unregistered investmentadvisors and influencers. E) Trading / Trading in “Options” based on recommendations from unauthorised / unregistered investment advisors and influencers. Company Designation Appointment Date Cessation Date Login to view this information. Traders should use add few lagging indicators to balance the effect. (i.e. one started two years ago and another one started one year ago) on the Sensex Chart.

What Does On-Balance Volume Tell You?

This signals a possibility of uptrend and breakout of price from trading range. This is a stage where smart money comes in the markets and process of accumulation begins. Overall the OBV is a useful indicator to confirm movements in price and identify potential reversals. As with all indicators, it is best to use OBV with additional technical analysis tools. Bullish divergence signals are useful to predict a trend reversal. A bullish divergence forms when OBV moves higher or forms a higher low even while prices move lower.

Ripple (XRP) Price Prediction: Filecoin (FIL) Price And Collateral … – Bitcoinist

Ripple (XRP) Price Prediction: Filecoin (FIL) Price And Collateral ….

Posted: Fri, 28 Apr 2023 18:08:52 GMT [source]

A bullish divergence occurs when the price of an asset is making lower lows, but the OBV line is making higher lows, indicating that buying pressure is increasing. A bearish divergence occurs when the price of an asset is making higher highs, but the OBV line is making lower highs, indicating that selling pressure is increasing. “Prevent unauthorised transactions in your account, update your mobile numbers/email IDs with your Stockbroker/Depository Participant. Receive information of your transactions directly from Exchange/Depository on your mobile/ email at the end of the day. As a business we do not give stock tips and have not authorized anyone to trade on behalf of others.

The exit point of this trade is when price gets to oversold levels as identified by the OBV. When price continues to make lower troughs and OBV fails to make lower peaks, the downward trend is likely to stall or fail. When price continues to make higher peaks and OBV fails to make higher peaks, the upward trend is likely to stall or fail. However, OBV is a leading indicator and it is likely to give you false signals sometimes. In addition, during extreme volatile sessions, the OBV indicator may not be useful and it will not represent the trend. Conversely, if prices are moving sideways and OBV indicator is falling, then it shows.

OBV should always be used in the daily chart in correlation with the closing chart. On balance volume measures the buying and selling pressure on a stock on a cumulative basis which subtracts volume on days the market trends down and adds volume on the uptrend days. People often use OBV to confirm price trends and also look for divergence between price and OBV. Forex technical analysis indicators are regularly used by traders to predict price movements in the Foreign Exchange market and thus increase the likelihood of making money in the Forex market.

It is a cumulative indicator that adds volume on up days and subtracts volume on down days, giving traders an idea of the strength of buying and selling pressure. An OBV is a technical indicator that helps ascertain a relationship between the share price and volumes. When OBV and price both follow the same direction, regardless of the trend, we can draw a trend line in price as well as in volume to watch for pattern similarities. It helps find the divergence in thought process between market stakeholders, who are institutional investors and retail investors, and may possibly indicate towards buy or sell signals.

Moreover, OBV should always be used in the daily chart in correlation with the closing chart. Another important and interesting factor of On Balance Volume is an advanced breakout. This is called a non-confirmation and such type of non-confirmation do and can occur at the end of an uptrend. Hence both charts i.e. price chart and OBV chart will almost look identical.